This is the last part...unless I decide to write another part, which is unlikely.

This part is about Washington Mutual...re-branded as WaMu at some point in 2006, then again as "Chase" when the company went tits-up in 2008.

I worked for WaMu for over 2 years -- starting as a temp in 2004, then as a full-time employee until 2006...when I was laid off.

I enjoyed my time at WaMu. I worked with great people, including two of the finest managers I've ever worked for. I was grossly overcompensated for the position I maintained, but I felt valued, and I felt that I made valuable contributions. In spite of the flip title of this series, I do not think I can be held truly accountable for WaMu's demise (which led to further collapses).

No, that distinction goes to three WaMu executives who really screwed the pooch, broke the bank, and helped ruin the US economy.

The first, of course, is Kerry Killinger...CEO and Chairman of Washington Mutual starting in 1991. I don't blame him entirely -- he ran a very good company for over two decades, and made some shrewd business decisions in that time. Washington Mutual was a fantastic bank with a good reputation locally, and it was starting to expand nationally with well-timed, ambitious acquisitions. It had one of the best retail banks in the nation, and its mortgage division was growing rapidly.

Unfortunately in 2005 Mr. Killinger decided to hire some New York asshole named:

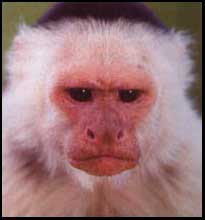

Stephen Rotella, who is the second guy I blame. I actually think he was the most responsible for the collapse of the business. Honestly...all I have to do is show you a picture of the dude's face. I mean, just look at it:

Ugh.

Shortly after I was hired full-time, I remember, reading that long-time executive Deanna Oppenheimer was leaving the company in 2005. She was a well-liked, highly valued member of the company with deep Seattle roots. I never met her personally, but she seemed incredibly competent and (as it turns out) she was heavily responsible for the success and growth of the retail bank.

Unfortunately for WaMu, in 2005 she made the incredibly prudent decision to work at Barclays...which is the 4th largest bank in the entire world.

Unfortunately for WaMu, in 2005 she made the incredibly prudent decision to work at Barclays...which is the 4th largest bank in the entire world.

In her place Kerry Killinger hired that above-pictured jag-off from New York, who had worked as an executive at JPMorgan Chase for a couple of decades. Once he got to Seattle, Mr. Rotella immediately set about attempting to convert WaMu from a well-liked, local-feeling, friendly thrift bank into a soulless multinational corporation full of money. And it might have worked too...if the economy hadn't collapsed into a pile of shit beneath his feet -- quite a bit of which was shit of his own creation.

Mr. Rotella hired the last guy I blame -- David Schneider; also from New York and JPMorgan Chase. Mr. Schneider was brought in as the new "President of Home Loans." A few months before I was laid off I attended an event introducing David to the "WaMu family," where he was set to give a speech to the adoring faithful.

During his presentation, he looked and sounded a bit like Ray Romano...and he joked about the difficulties of moving to Seattle, made lighthearted comments about the weather, and poked fun at Seattle's sports teams.

During his presentation, he looked and sounded a bit like Ray Romano...and he joked about the difficulties of moving to Seattle, made lighthearted comments about the weather, and poked fun at Seattle's sports teams.

Needless to say, I did not like him. At all.

Here's a video of him getting "grilled" by Senator Levin: http://www.youtube.com/watch?v=XvFBJVhNpiM

Ahhh....schadenfreude.

Here's a video of him getting "grilled" by Senator Levin: http://www.youtube.com/watch?v=XvFBJVhNpiM

Ahhh....schadenfreude.

So what did those three guys do? How did they screw things up?

I don't know specifically...since I was not privy to any meetings at the "executive" level. But there are hundreds of articles online detailing the shady lending practices at WaMu, and explaining the decisions that led to the company's eventual demise. Drew DeSilver wrote a very good two-part series for the Seattle Times. If you want a macro view of what happened, you ought to read that...because all of that shit is beyond my purview.

I don't know specifically...since I was not privy to any meetings at the "executive" level. But there are hundreds of articles online detailing the shady lending practices at WaMu, and explaining the decisions that led to the company's eventual demise. Drew DeSilver wrote a very good two-part series for the Seattle Times. If you want a macro view of what happened, you ought to read that...because all of that shit is beyond my purview.

Hell, if you want an even better examination of the collapse, read "The Lost Bank" by Kirsten Grind. I mean, I haven't read it (though I plan to), but I hear it's pretty good.

What I will detail for you is my own "micro" view of what happened...drifting out from my lowly position in a cubicle near a window on the 6th floor of the Washington Mutual Tower.

My first hint that things were not right with the company was when my manager Paulette (one of the finest people I have ever worked for) was going over the details of a loan with me. She was perplexed by something, and whispered aloud:

"What are we doing giving a $1.5 million dollar low-doc Option-ARM to someone with a 587 FICO?"

I didn't know what she was talking about...but it turns out it was a good question....a very, very good question that should have been screamed at the upper management repeatedly.

But it was a question that, apparently, no one else was asking. And if they were asking it, no one was actually doing shit about it.

To explain, low-doc was the WaMu term for a "Stated-Income Stated-Asset" loan...also known as a liar loan.

An Option-ARM loan is a loan with four monthly payment options -- the minimum payment (you pay a very small amount, essentially losing equity via negative amortization), the interest-only (you only pay the interest, and build zero equity), the 30-year fully amortized (the standard payment option) and the 15-year fully amortized (for people with too much goddamn money). This product was created to give the borrower options -- say one month they had to get car repairs...all they had to do was pay the "minimum payment" for one month, then return to normal payments the next month.

Easy peezy.

An Option-ARM loan is a loan with four monthly payment options -- the minimum payment (you pay a very small amount, essentially losing equity via negative amortization), the interest-only (you only pay the interest, and build zero equity), the 30-year fully amortized (the standard payment option) and the 15-year fully amortized (for people with too much goddamn money). This product was created to give the borrower options -- say one month they had to get car repairs...all they had to do was pay the "minimum payment" for one month, then return to normal payments the next month.

Easy peezy.

Gone were the rigid confines of a set monthly payment. Payments were now fully controlled by the borrower! Huzzah!!!

At least, that's how it was advertised. I should know -- they pitched me the product at my employee initiation. At the time, I thought it sounded like a pretty good idea...because I was a stupid 25 year-old idiot who didn't know a damn thing about home loans.

Because, what the loan officers probably failed to tell you was that you could only go up to 110% of your original loan amount using the "minimum payment" option. After that, you had to start paying the full amount and then some. Stupid doing what stupid does, a large number of people (up to 80% by some reports) only payed the "minimum" amount, expecting their situations to improve or their home values to go up.

But situations for everyone deteriorated rapidly. Home prices sunk like a rock. Many people lost their jobs. And many more people lost their homes.

Bing bang boom.

But like I said, WaMu loved that Option ARM bullshit. It was, by far, the most popular product we offered. I should know -- our group looked at a lot of the loans that came through the pipeline. A large percentage (some reports say up to 55%) were Option ARMs.

Upper management was pushing this product hard. The group situated next to ours was the crew that published the daily rate sheets. More and more we could see that the credits standards were being relaxed. Penalties for low FICOs were being eased. Penalties for Low Doc loans were also being removed. I wish I'd have saved some of those sheets, because the permissiveness (compared to today's market) was fairly absurd in retrospect.

Speaking of things I wish I'd saved, I remember reading an internal Q&A from Mr. Rotella (or perhaps it was Mr. Schneider) that talked about the company's intended shift from A-Paper (good) loans to Alt-A (shitty) loans. The executive answering questions (either Rotella or Schneider) seemed to think it was a splendid idea. The question was something like, "Are we still going to be pursuing A-Paper loans in our portfolio?" To when the executive responded with something to the effect of "We will be significantly scaling back our A-paper mortgages, and aggressively pursuing exciting opportunities in the Alt-A and subprime markets."

I feel like I printed that out or saved it somewhere...but I could be wrong. I don't know...I've moved a lot and I have a lot of new computers. I feel like printed out a page with Steve Rotella's head, surrounded by all of the shitty quotes I could find from his terrible business decisions.

Of course, speaking personally, the most damaging change that Mr. Rotella made was the decision to send our group (along with many other regulatory oversight groups and loan processors) to a "low cost" area in Columbia, South Carolina.

This move cost me my job, along with the entirety of my over-inflated salary.

I had the "pleasure" of visiting Colombia to train my replacements.

Now, one of the side-effects of a move to a "low-cost" area is that you have to hire local, "low-cost" employees. I mean...I'm not saying that everyone in Columbia was dumb...I'm just saying that the people who were taking over my job were dumb. While I was there, I gave a very simple presentation, which was met with a lot of glassy-eyed stares.

There were competent folks among them, sure...but most of those competent folks came to Columbia from other parts of the country because they wanted to keep their job (the options: move to Columbia or be laid off). Once those competent employees gained a smidge of self respect, they realized that they were in Columbia and that no job was worth living in that god awful shit-hole..

Of course, there's a whole 'nother part of the company that played a big part...but I never witnessed much of that (subprime loans were handled by a different department). But if you want to read about Long Beach Mortgage's contribution, you go to this article...also from the Seattle Times. It's pretty damning.

I also distinctly remember Paulette looking at loans from one of the "big producers" in California. The loan officer was untouchable due to his incredibly high volume, and he received more than a few "pricing exceptions" from our office. I don't remember his name or even where he was from...but there's a damn good chance he was one of the people mentioned during senate testimony, which revealed that the office where he worked "had levels of fraud exceeding 58 percent and 83 percent of the loans."

I'm pretty sure we knew he was cheating...but we couldn't do anything about it even though we tried.

I also distinctly remember Paulette looking at loans from one of the "big producers" in California. The loan officer was untouchable due to his incredibly high volume, and he received more than a few "pricing exceptions" from our office. I don't remember his name or even where he was from...but there's a damn good chance he was one of the people mentioned during senate testimony, which revealed that the office where he worked "had levels of fraud exceeding 58 percent and 83 percent of the loans."

I'm pretty sure we knew he was cheating...but we couldn't do anything about it even though we tried.

Anyway, shortly after my presentation in Columbia I left the company...with a surprisingly generous severance package. Consequently, I didn't get to see WaMu in its final death throes. But the company's fate had already been sealed at that point, in my opinion. Once you add all the things I talked about -- the championing of the Option ARM, Long Beach Mortgage, the relaxing of borrower credit standards, and the outsourcing of those tasked with pricing oversight...what you get is a heap of shitty shit mortgages that drowned the company.

I guess I should go read that "The Lost Bank" book now...to see if my instincts about this thing were right after all...

No comments:

Post a Comment